From 1 August, if you often check your bank balance by using the UPI app, your limits will be limited. You will not be able to check your balance more than 50 times a day using an UPI app. These new rules will apply to all – users, banks and merchants, all. Let us take a look at these changes and their effects through questions and answers.

Question 1: What are the changes happening in UPI?

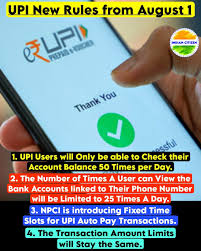

Answer: There will be many updates in UPI from 1 August. The main changes include:

1. Limit to check the balance daily: You will be able to check your bank balance only 50 times a day using one UPI app.

2. Automatic payment time: Automatic payment (eg loan, subscription or bill) will now be at any special time instead of any time in the day.

3. The range of checking the position of the transaction: If a payment is stuck, you can see its position only 3 times, there will be a interval of 90 seconds between each investigation.

Question 2: Why are these changes necessary?

Answer: National Payment Corporation of India (NPCI) states that the demand for UPI system has increased considerably, especially busy time (from 10 am to 1 pm and 5 pm to 9:30 pm). Repeated balance and checking the condition can slow down the system.

In April and March 2025, UPI services led to a lot of interruptions, affecting millions of users. The purpose of these changes is to make the system fast, more reliable and without any interruption.

Question 3: What are the new fixed time for automated payments?

Answer: Automatic payments (such as your Netflix subscription, mobile recharge or loan payment) will now be processed in a short busy time. These are the time:

1. before 10 am

2. between 1 pm to 5 pm

3. After 9:30 pm

This change will reduce the workload of the system and will speed up the transaction.

Question 4: Will these changes apply to all the people using UPI?

Answer: Yes, these new rules will apply to all UPI users, whether you use any app like PhonePe, Google Pay or Paytm. If you often do not see how much money you have or do not refresh your transaction situation repeatedly, then you probably will not see a big change.

Question 5: What will be the effect on common users?

Answer: There will be no major changes for common users. You can pay daily as before, fill the bill or send money. However, if you check your balance more than 50 times a day, then you have to close it after reaching that limit. Auto-pay bills will still be paid automatically on time, so you do not have to do anything for it.

Question 6: Has there been any change in the limit to transfer money through UPI?

Answer: No, how much money you can send, its limit will remain the same. You can send up to Rs 1 lakh for most transactions, and you can send up to Rs 5 lakh for payment of healthcare or education. These new rules do not affect these limitations.

Question 7: Do users need to do anything?

Answer: No, you don’t have to do anything. These changes will happen automatically in your UPI apps. Just keep in mind how many times you check your balance, so that you do not have any problem.

Read Also:

- UPI Payment Will Soon Be Made With Fingers Mark: New Feature Is Coming Soon, Now People Use PIN For Payment

- Cyber Literacy- Beware Of UPI Auto Pay Scam: Always Keep In Mind Five Things, Now Don;t Pay For Unknown Payment Requests, Check Out The Maths Of This Rip-Off

- UPI Charge Has Become 50% Faster, Most Of The Transaction Restriction Is 15 Seconds: Stability Testing Time Additionally Decreased; Learn The Adjustments In 7 Questions And Answers

- No Charges Can Be Levied On UPI Transactions: News Of Charging ₹9 From Shopkeepers On A Fee Of ₹3000 Is Fake

- Soon You Will Be Able To Withdraw PF Money From UPI-ATM

- No Tax On UPI Transactions Above ₹2,000: Finance Ministry Calls GST Imposition Reports Fake; Incentive Scheme Extended Last Month

- What Is UPI And How Does PhonePe Use It

- UPI Apps Server Down

- Important News- What Is UPI Pull Transaction Which Is Being Prepared To Be Closed, Will This Stop UPI Fraud, Know From The Expert

- UPI Will Not Work On Inactive Mobile Numbers From April 1: NPCI Decision To Prevent Cyber Fraud, Pull Transaction Feature Will Also Be Closed

- Investigation Of India Digital Financial Scenario: A Comprehensive Study Of Cyber Fraud Trends And Digital Literacy In India

- Withdraw Money From ATM Without Card: SBI Allows You To Withdraw Money Without Debit Card; Here Is The Easy Process Described In 6 Stages

- At Present, Most Bank Employees In India Are More Concerned About Their Salary Rather Than Their Work

- Need To Adopt A Fully Educated Employee System To All Banks Of India To Help Uneducated And Untrained Persons In ATM Transactions, Money Deposits And Debit