This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Read More

Money and Currency

-

A Joint Home Loan Might Become A Headache For You! Know Its Advantages And Disadvantages

Are you planning to take a joint home loan? So you should be aware of its benefits and disadvantages. Sometimes a joint home loan can be beneficial for some people,…

-

Complete Information About Closing The Loan

According to research, it has been found that 67% of Indians have taken a personal loan at least once in their life to meet their needs. You will also be…

-

What Are The Advantages And Disadvantages Of A Loan

Nowadays, taking a loan has become easier than earning money, so let us tell you that you can take a loan sitting at home with your Aadhar card and PAN…

-

Advantages And Disadvantages Of Business Loans

In this article you will read about the advantages and disadvantages of business loans. Business loans are a popular type of funding for entrepreneurs and business owners. This is especially…

-

Which Loans Offer Advantages And Disadvantages? Before Taking A Loan, Know Well About Good And Bad Loans

First of all, let us know what is a good loan? These are those loans, taking which increases your net worth. In this the interest rates of the loan are…

-

Money (History, Types And Role)

From the beginning of time, money has been an integral part of human civilization. It is a means of exchange that allows us to trade goods and services, and it…

-

Importance Of Money

We can say that money is a fundamental necessity of life. Without money, it is impossible to imagine a healthy and good life. We need money to fulfill any of…

-

What Is Money And Its Classifications

Money is that which is generally accepted; whenever we need to buy anything, we can easily purchase it by paying money. The value of the money we pay is what…

-

Create Credit Score Like This With The Help Of Secured Credit Card

Having a good credit score not only gives you many loan options but you can also negotiate with banks and NBFCs to get a loan on better terms. However, those…

-

What Is Loan And How Many Types Of Loans Are There

Loan is a financial assistance that provides you instant money for any big or small need. Whether buying a home, studying abroad or meeting an emergency, a loan can be…

-

How To Make Money With Paytm (9 Great Ways)

Do you know how to earn money from paytm? Who is there in the present time who does not want to earn money, and if money starts being received sitting…

-

What Is Loan And How To Take It

You must also have such very telemarketing calls, which are really very irritating. But do you know what this Loan is? Why is it being provided so easily now? What…

-

What Is Personal Loan And How Many Types Are There

In the modern world, loan is no longer an unknown term. People choose loans for many purposes. This can be for marriage, travel, home buying, higher education, and many other…

-

What Is Bitcoin

Bitcoin is a digital currency that works completely free, that is, no bank or government controls it. A currency that is completely virtual. You can also consider it an online…

-

Which Bank Is Offering The Cheapest Education Loan In The Year 2025? List Of Banks

The college admission season has begun in 2025, and the increasing spending of higher education is becoming a challenge for parents and students. Know the information of the cheapest education…

-

Planning To Get A Personal Loan? Tie These 5 Things Before Selecting The Lender

You should also collect lander information before taking a personal loan. Let us tell you 5 such points today which should be kept in mind before taking personal loan. Nowadays…

-

Gold Loan Rising Craze, People Turning Away From Microfinance? See New Picture Of Changing India

Millions of small borrowers in India are now moving away from microfinance to gold loan. Gold prices reached record highs, low interest rates on gold loans and strict policies of…

-

Top-Up Loan Vs New Loan: Is A Top-Up Loan Better For Your Financial Goals

Which option should you choose between a top-up loan or a new loan? Both have their own advantages and disadvantages. Let’s understand the difference between a top-up loan and a…

-

What Is A Mutual Fund? Know Everything Before Investment – Complete Information

Do you want to step into the investment world, but are afraid of the complications of the stock market? Are you looking for a way where your money is managed…

-

How To Explain The Importance Of Money To Children, Read These Four Guru Mantras

Worrying about the future of your children is something that every parent is worried about. The first worry is about the health of the children and the second is how…

-

Health Insurance Premiums Are Getting Expensive, These Methods Can Save Money

Health insurance is considered a strong security cover in financial planning. Its importance has increased even more due to the ever-increasing treatment costs. But in recent times, one concern is…

-

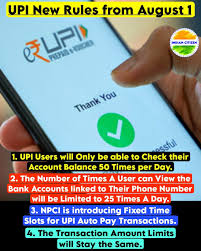

The New Rules Of UPI Will Apply From August 1: You Will Be Able To Check Your Balance At A Day Only 50 Times A Day, And The Time Of Automatic Payments Will Also Change

From 1 August, if you often check your bank balance by using the UPI app, your limits will be limited. You will not be able to check your balance more…

-

UPI Payment Will Soon Be Made With Fingers Mark: New Feature Is Coming Soon, Now People Use PIN For Payment

UPI users will soon be able to pay their fingers or facials. According to the news sources, the NPCI managing UPI is preparing to allow payment through biometrics. After this…

-

Withdraw Money From ATM Without Card: SBI Allows You To Withdraw Money Without Debit Card; Here Is The Easy Process Described In 6 Stages

If you have forgotten your debit card or fear of losing it, you can still make safe transactions from ATM. State Bank of India (SBI) has launched a facility called…

-

At Present, Most Bank Employees In India Are More Concerned About Their Salary Rather Than Their Work

In recent years, there have been significant changes in the banking sector in India, both technical and operating significant changes. Despite these comrades, a worrying trend is becoming increasingly clear…

-

Need To Adopt A Fully Educated Employee System To All Banks Of India To Help Uneducated And Untrained Persons In ATM Transactions, Money Deposits And Debit

India, being a vast and diverse nation, is a complex group of people with various levels of education, literacy, financial awareness and digital contact. Despite the introduction of the Pradhan…

-

Need To Adopt A Fully Educated Employee System For All Banks Of India To Fill The Form And Assist In Other Banking Works To Uneducated And Untrained Persons

India, the second largest population of the world, is home to immense variations-not only in culture and language, but also in education, ease and socio-economic progress. In such a complex…

-

Prominent Person Of The Reserve Bank Of India (RBI)

The Major Banking Institute of India, the Reserve Bank of India (RBI), has been managed and directed by several prominent individuals since its inception in 1935. These individuals have contributed…

-

Headquarters Of Reserve Bank Of India (RBI)

The headquarters of the Reserve Bank of India (RBI) refers to the important administrative office where the supreme decisions related to the financial, banking, currency and financial system of India…

-

History Of Reserve Bank Of India (RBI)

The Reserve Bank of India (RBI) is a major financial institution of India, which was established to control the release and distribution of Indian rupees and maintain economic balance in…

-

Reserve Bank Of India

The Reserve Bank of India, often abbreviated as RBI, is India’s major banking group, which is responsible for the release of Indian rupee and distribution and management of the country’s…

-

Why Getting Your Cash- FD Is A Loss Deal: Now Now Don’t Preserve The Entire Financial Savings In FD, Just Preserve A Little, Different Alternatives For Secure Funding And Higher Returns

Many people paintings hard for years and upload cash in our financial savings account. When some cash is collected, we get it FD (Fixed Deposit). Most of the humans in…

-

UPI Charge Has Become 50% Faster, Most Of The Transaction Restriction Is 15 Seconds: Stability Testing Time Additionally Decreased; Learn The Adjustments In 7 Questions And Answers

UPI charge has become 50% faster from these days. That is, now your charge can be finished in most 15 seconds, now you will not need to guess 30 seconds…

-

No Charges Can Be Levied On UPI Transactions: News Of Charging ₹9 From Shopkeepers On A Fee Of ₹3000 Is Fake

No charges can be levied on Unified Payments Interface (UPI) transactions. The Finance Ministry on Wednesday (June 11) published a notice on X and called the information of charging on…

-

Payment Fraud

Payment fraud is one of the most demanding situations going through company treasurers today, with criminals focusing on organizations of all sizes and in all industries. Fraudsters are getting right…

-

Nine Of The Pinnacle 10 Organizations Saw Value Improve By ₹ 1 Lakh Crore: Reliance’s Market Cap Improved The Most By ₹ 30,786 Crore, TCS’s Declined The Least By ₹ 28,510 Crore

In phrases of marketplace capitalization, the fee of four of the pinnacle 10 organizations of the country have improved by ₹ 1 lakh crore with the remaining week. During this…

-

Now Don’t Choose The Wrong Form In ITR Submitting: It Can Get Your Refund Stuck, Keep Away From Those 10 Errors, Even As You Go Back To Submit ITR

If your earnings fall below the tax slab, it is very important to be able to document the Income Tax Return (ITR). Often people make errors in submitting ITR. This…

-

Getting 0.33 Festive Coverage Of Automobiles Can Be Costly: IRDAI Recommends Bumping Up Top Rate By Means Of 18-25%, Recognize How Much Extra Cash Should Be Paid

Getting 0.33 festive coverage of automobiles can be costly. According to media reports, the Insurance Regulatory and Development Authority of India (IRDAI) has recommended the authorities to bump up the…

-

You Will Now Get More Loans On Gold: Banks To Lend Up To ₹85,000 On Gold Worth Rs 1 Lakh; RBI Changes Rules

The Reserve Bank of India (RBI) has made a big change with the guidelines for gold loans. The Reserve Bank has increased the loan-to-rate (LTV) ratio from 75% to 85%…

-

YES Bank Stock Falls By 9%: 9.4 Crore Shares Traded As Fast As Possible Due To The Market Open Truth; 20% Stake Revised Last Month

YES Bank stock fell by 9% on Tuesday, June 3. The business enterprise’s inventory is presently looking and selling at Rs 21.30, which is roughly Rs 2. The block deal…

-

SEBI Approves HDB Financial’s IPO

SEBI Approves HDB Financial’s IPO: Company To Raise Rs 12,500 Crore From Trouble, HDFC Bank Will Certainly Sell The Issuer At A Price Of ₹ 10 Thousand Crore HDFC Bank’s…

-

Now You Can File ITR: Income Tax Department Issued ITR-1 And ITR-4 Forms, Last Date 15 September

Income Tax Department has made available Excel Utility for ITR-1 and 4 for Financial Year 2024-25 or Assessment Year 2025-26. The department said on Friday that taxpayers can now file…

-

Investing In Senior Citizen Saving Scheme Can Prove Helpful In Old Age: You Can Earn Rs 20,500 Every Month, Know Its Complete Mathematics

By investing a lump sum amount in the Post Office Senior Citizen Saving Scheme Account (SCSS), you can arrange regular income for yourself even after retirement. At the moment it…

-

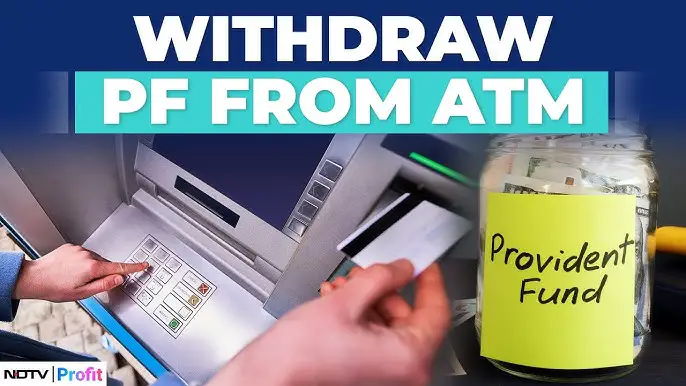

Soon You Will Be Able To Withdraw PF Money From UPI-ATM

The new facility will be available from June, with this you will still be able to withdraw money if needed. The Central Government Employees Provident Fund Organization (EPFO) is preparing…